- All

- Benefits

- Contracts

- Ethics

- Fiduciary

- Litigation

- PBM

- Updates

The Law Changed. The Game Hasn’t. Cigna’s CEO Told Wall Street PBM Reform Won’t Affect Profits Executive Brief On February 3, 2026, President Trump signed the Consolidated Appropriations Act (CAA) of 2026 into law. The legislation includes the most comprehensive federal PBM reform package ever enacted. 100% rebate pass-through. Spread pricing prohibitions. Expanded ERISA 408(b)(2) disclosure requirements. Semi-annual reporting. Enforcement penalties of $10,000 per day. This is a generational…

The Question You Didn’t Ask What The Voluntary Benefits Lawsuits Reveal Executive Brief The Schlichter voluntary benefits lawsuits filed in December expose a two-part failure most employers share: fiduciaries skipped compensation disclosure requests, and when disclosure existed, they accepted the amounts without evaluating reasonableness. That’s the allegation against United Airlines, Labcorp, Community Health Systems, and Allied Universal. Major consultancies are named as co-defendants:…

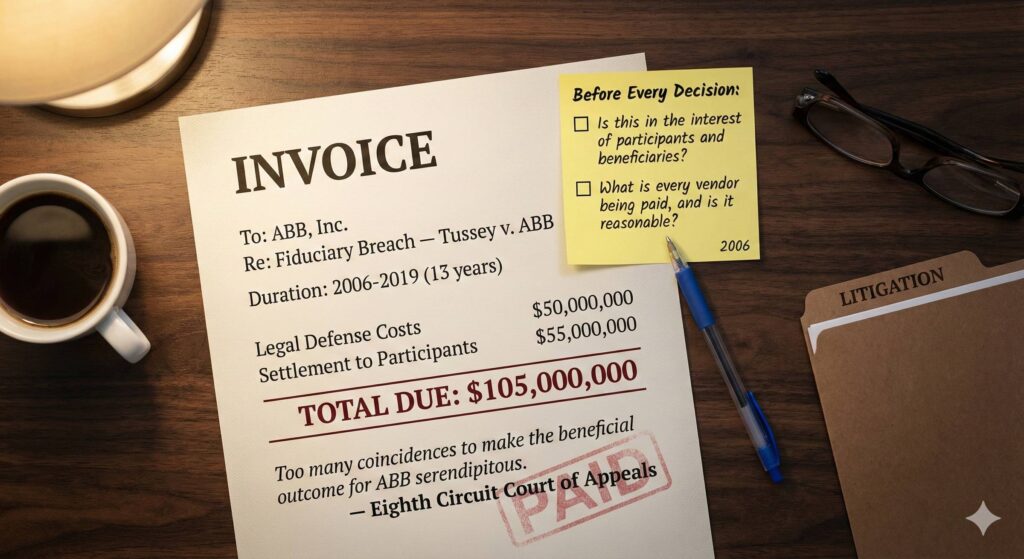

13 Years as a Defendant How One Recommendation Led To A $105 Million Lesson Executive Brief Thirteen years is a long time to be a defendant. In December 2006, John W. Cutler, Jr. was doing his job. As Director of Pension and Thrift Management at ABB, Inc., he staffed the Pension Review Committee and made recommendations about the company’s 401(k) plans. One of those recommendations was to replace the Vanguard Wellington Fund with Fidelity Freedom Funds. That recommendation made him a…

Voluntary Benefits. Involuntary Liability The ERISA Trap 80% of Employers Have Already Triggered Executive Brief In a recent Health Rosetta webinar on the Schlichter Bogard lawsuits, ERISA attorney Julie Selesnick asked attendees to rate their confidence level on whether their voluntary benefit plans qualified for the ERISA safe harbor. 49% said they were confident. Then she shared the data: more than 80% of voluntary benefit plans end up being subject to ERISA because they fail to meet the…

The Governance Reckoning What Schlichter Lawsuits Mean for Health Plan Fiduciaries Executive Brief Last week, the Schlichter Bogard law firm, the same plaintiffs’ attorneys who transformed retirement plan governance through two decades of ERISA litigation, filed a wave of health plan lawsuits against major employers and benefit consultants. This was not a legal moment. It was a governance reckoning. The cases didn’t create new fiduciary duties for health plans. They made existing ones…

The Year Fiduciary Risk Came Home Why Healthcare Just Entered Its 401(k) Moment Most years begin with predictions.This one begins with confirmation. For nearly a decade, some industry observers have been warning ERISA fiduciary risk in health plans was building quietly, unevenly, and largely unnoticed. Not because employers did not care. But because the enforcement mechanisms that reshaped retirement plans had not yet arrived in healthcare. Something changed on December 23. On that day,…

A New Year Reset for Fiduciaries Clarity Isn’t Coming. It’s Chosen. A new year doesn’t magically fix what’s broken. January reveals who is willing to keep living with it. Every year, health plan fiduciaries face the same quiet decision.Will this be the year they challenge conflicts hiding in plain sight? Or the year they let them keep running in the background. After a year of legal false starts, regulatory noise, and “transparent” solutions that were anything but, one truth stands out:…

It’s Hard Out Here for a Fiduciary Year-End Reality Check Being a fiduciary was never supposed to be easy. But does it need to be this hard? 2025 made one thing painfully clear: If you were waiting for the courts, regulators, or Congress to save you, you’re likely still waiting. This year brought real advancements, real setbacks, and a lot of uncomfortable clarity about the fiduciary status quo and where responsibility actually sits. And if you’re responsible for a health plan, that clarity…

How to Get Real Value From This Newsletter Welcome! Let’s Get You Oriented. If you’re new(ish) or haven’t yet explored all the newsletter issues, this is your roadmap. Most newsletters fade after a few months.This one didn’t. What started as a weekly attempt to untangle healthcare complexity has turned into something much more: A growing community of fiduciaries, advisors, and executives who want better answers and are willing to act on them. Last week’s anniversary giveaway wasn’t just a…

Download Before They’re Gone Don’t Miss This (Deadline Tonight) Just a quick final reminder. Today is the last day to download your free anniversary gifts. If you’ve already grabbed the 3-book set, Thank You! You’re entered in tonight’s drawing automatically. If not, here’s what you’ll miss after midnight: 📘 The Full Fiduciary Handbook 3-Book Set Essential Guide, Solution Guide, and the Fast Start Kit. Free for every subscriber. 🎓 Win One of Five Free Seats Certified ERISA Fiduciary…

Your Fiduciary Resources Are Waiting Don’t Miss This (Deadline Friday) On Monday, I shared a set of gifts to mark the one-year anniversary of this newsletter. In case you missed it, here’s a quick reminder so you can take advantage before the Friday deadline. Over the past year, you’ve been part of a community that cares deeply about clarity, fairness, and fiduciary excellence. This anniversary felt like the right moment to give something meaningful back. Here’s what every subscriber can…

A Year of Writing. A Year of Purpose. Welcome to Issue #52 – A Milestone to Celebrate! 52 Week Giveaway Every Monday morning for the past year, I’ve hit send on this newsletter. Sometimes from airplanes.Sometimes from hotel rooms.Sometimes rewriting minutes before my self-imposed 7:00 a.m. deadline. Topics changed. The purpose didn’t. Compliance. Fiduciary duty. PBMs. Contracts. Rebates. Transparency. Each one matters. But they’re all part of a bigger story. When I started writing, it wasn’t…

Legal Doesn’t Mean Ethical Fiduciaries Should Know the Difference Executive Brief Let’s say the quiet part out loud:Rebates take money from sick employees and help discount premiums for healthy ones. And the moment you point this out, the defenses come fast: “But it’s legal.”“Fiduciaries must treat everyone equal.” Those aren’t explanations.They’re rationalizations. Here’s the truth: A health plan that relies on sick people overpaying for drugs isn’t “balanced.” It’s broken. Legal?…

Whose Money Is It, Really? The Rebate Dilemma Why fiduciaries must confront the conflict no one talks about Executive Brief It’s Not About Percentages. It’s About Priorities. Here’s the truth almost no boardroom discusses: Rebates come from your sickest employees. Every rebate dollar exists because someone with a serious condition filled an expensive prescription. Yet the financial “benefit” of those dollars is usually spread across everyone while the high-need claimant keeps paying…

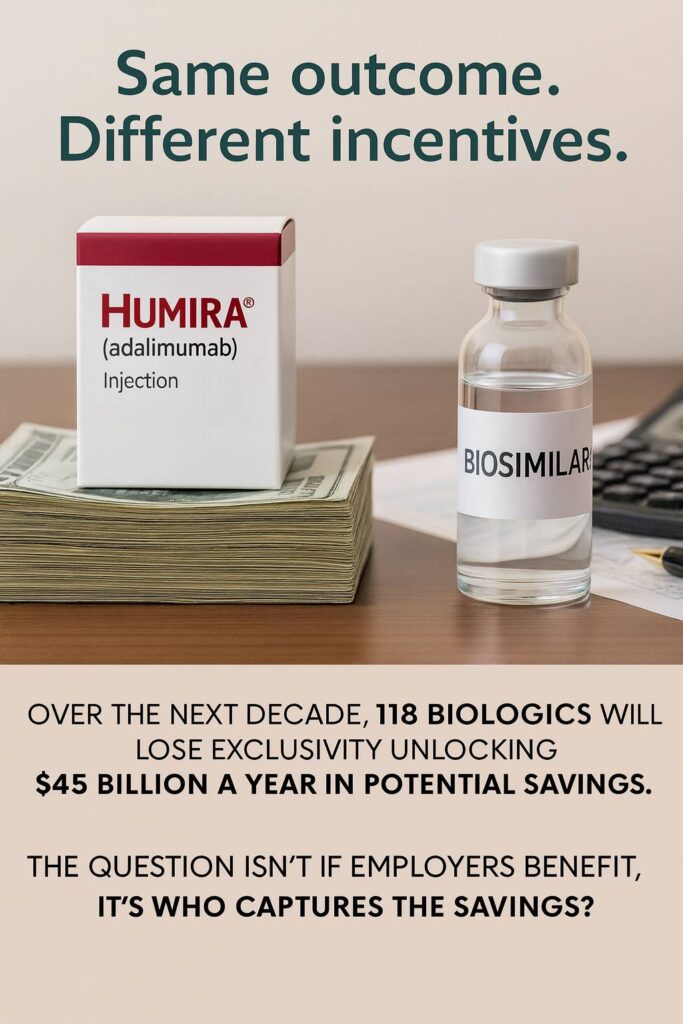

The Rebate Trap Why Employers Won’t Let Go And Why Fiduciaries May Not Have a Choice Much Longer Executive Brief Rebates have become the duct tape holding together an increasingly dysfunctional pharmacy benefit market. They prop up premiums, pad budgets, and help employers keep annual renewals from looking less unhinged than they really are. But here’s the uncomfortable truth: Rebates don’t magically appear. Your sickest employees generate them. That makes rebates more than a clever financing…

The PBM Breakup Letter Employers Are Moving On Employers are finally deciding to end their toxic relationship with PBMs that overpromise and underdeliver. It’s Not Us. It’s Definitely You. According to the WTW 2025 Healthcare Survey the breakup is already underway. And it’s getting serious. By 2027: ✅ 75% will rebid their PBM ✅ 35% will conduct acquisition-cost analyses ✅ 33% will partner with a new or emerging PBM WTW Highlights: Emerging PBM Strategies For years, employers were told to sit…

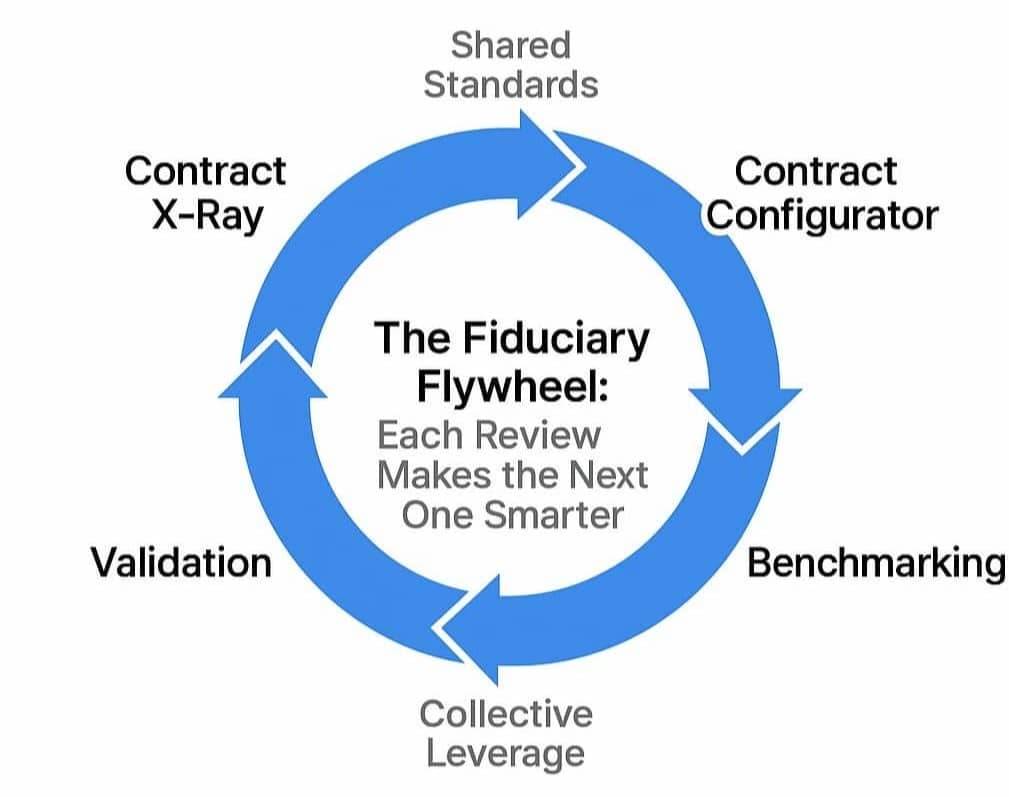

How Collective Action Fixes a Broken System The Fiduciary Network Effect Most employers still approach fiduciary reform as a solo project: negotiate with the PBM, fix the contract, clean up the data. But the real breakthrough happens when those individual actions connect. When transparency, accountability, and data all compound across organizations. That’s the Fiduciary Network Effect: where every improvement strengthens the system for everyone else. Executive Brief Why the Network Matters…

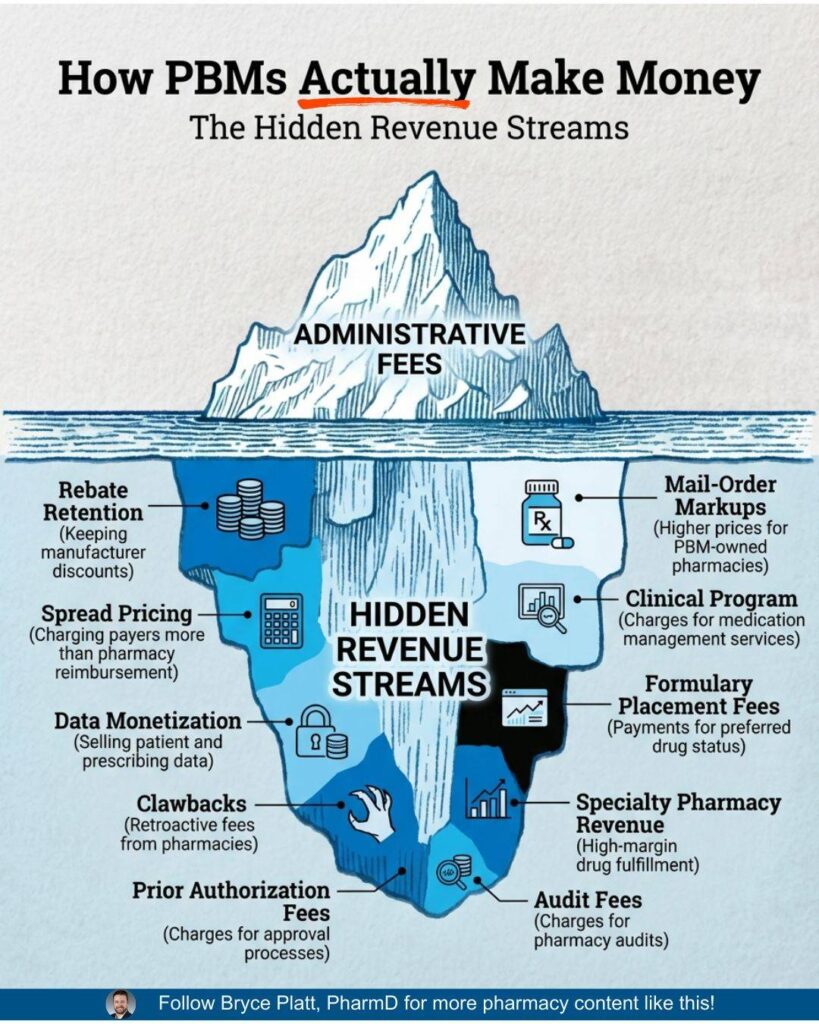

Twelve Steps of Fiduciary Recovery Breaking Free From PBM Dependency Executive Brief Fiduciaries Anonymous is now in session. The first step to fixing your health plan? Admitting you have a problem. PBMs and brokers built a system to keep employers hooked: opaque contracts, hidden fees, complex pricing, and “discounts” that actually inflate costs. We’ve been told:“There’s nothing you can do.”“It is what it is.”“We worked hard to limit your increase to 10%.” Who wants to admit defeat?…

Executives in the Dark How to Get CEOs Asking the Right PBM Questions Executive Brief A Kaiser Family Foundation survey dropped a bombshell: “Employers Haven’t a Clue How Their Drug Benefits Are Managed.” “Most employers have little idea what the pharmacy benefit managers (PBMs) they hire do with the money they exchange for the medications used by their employees.” – KFF survey of 2,142 companies Nearly half of executives admit they don’t fully understand PBM contracts, even though they’re…

PBM Reform Just Got Real RFx Tools & Contracts You Can Use Executive Brief Employers are tired of PBM opacity. We’ve changed the game. Nautilus Health Institute just launched a full suite of tools: PBM Field Guide, RFP builder, standard contract clauses, and dashboards — all designed to help employers act like fiduciaries and get better deals. And I’ll help you use them. Personally. Don’t be a bystander. Change the status quo and reap the benefits. New Tools & Resources Live Now Here’s what…

The Most Important Call Your CEO Hasn’t Taken Yet Mark Cuban Is Ready to Dial In—Literally Executive Brief Why This Message Needs to Reach the C-Suite Most employer sponsored health plans aren’t broken by mistake. They were broken by design to benefit middlemen—and are preserved by inertia. If you’re a benefits leader or CFO, here’s the hard truth: You probably don’t have the authority to fix the system alone. That’s why this week’s issue isn’t really for you.It’s for your boss. Your board….

From Frustration to Fix: The PBM Field Guide We’re putting PBM procurement back in the hands of fiduciaries at RosettaFest Executive Brief Two Big Moments. One Big Mission. Health plan fiduciaries are frustrated—and for good reason.Opaque pharmacy benefit deals.Conflicted brokers and consultants.No clear roadmap. This week at RosettaFest, that all changes. We’re proud to unveil the PBM Field Guide and the Nautilus Configurator—a pair of powerful tools that bring clarity, speed, and…

The Contract That Protects or Betrays When Fiduciary Duty Meets Contract Fine Print Most contracts protect the drafter. Healthcare vendor contracts go one step further: they memorialize conflicts of interest. They don’t just fail to protect you—they lock in the very practices that drain plan assets and put fiduciaries at risk. ERISA attorney Julie Selesnick put a fine point on it during a conversation this week: “These contracts are written to take you to the cleaners. They build in every way…

PBM Procurement Without the Pain A New Open Source Tool to Cut Through Contracts, Conflicts, and Compliance Risks Executive Brief The biggest ERISA class-action lawsuits have one thing in common: PBM mismanagement—often the result of lax compliance leading to poor procurement. Employer fiduciaries have a rare win-win opportunity: start with pharmacy benefits to take litigation risk off the table and deliver immediate savings. But traditional PBM procurement is a slog—months of manual prep…

When Fiduciary Duty Clashes With Civic Duty Should CEOs Join The Board Of A Hospital? Executive Brief You can’t serve two masters—especially when one sends your employees to collections. A CEO is invited to join the board of the local hospital—the same hospital that overcharges the plan, sues employees over bills, and refuses to share pricing data. That’s not a big honor. It’s a fiduciary problem. Fiduciary duty under ERISA requires loyalty to plan participants and their beneficiaries. Not to…

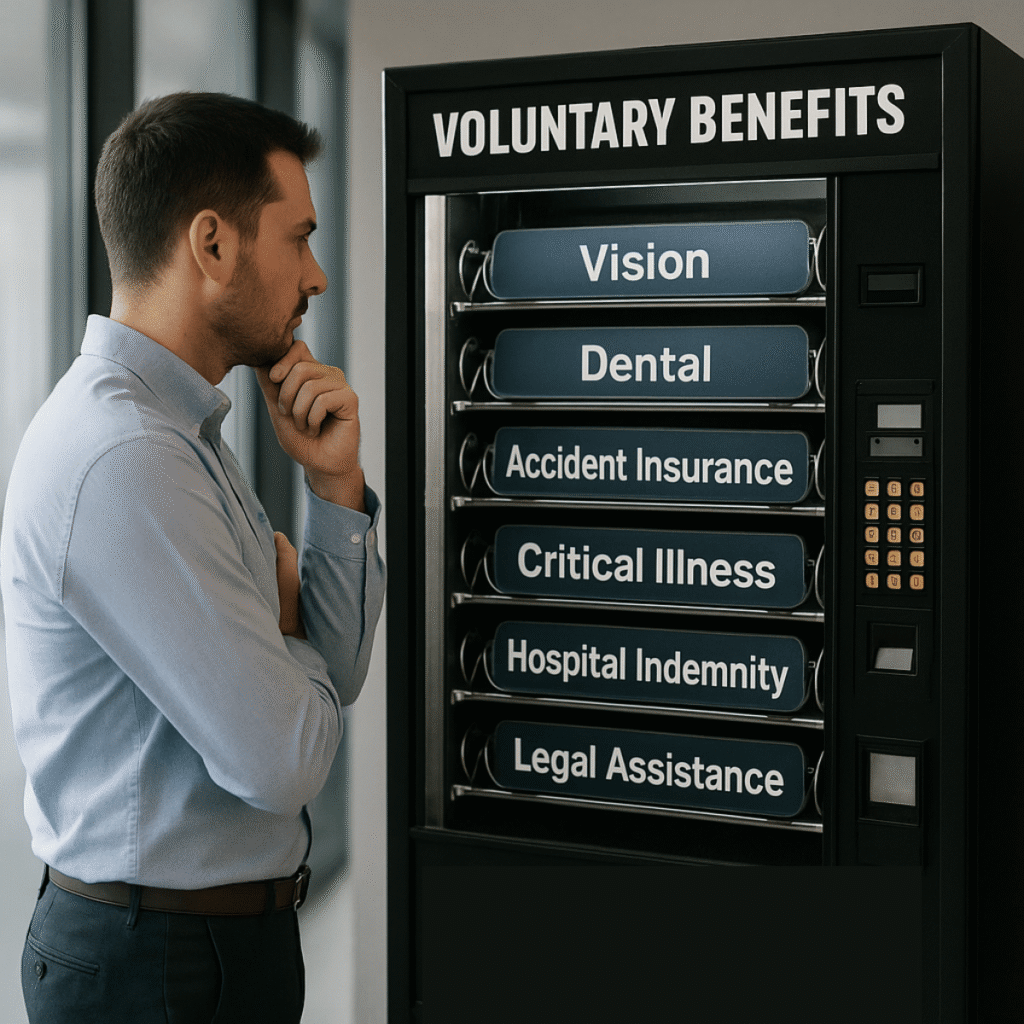

Popular Doesn’t Mean Prudent The Hidden Risks of Voluntary Benefits—and the Fiduciary Blind Spot Letting It Happen Voluntary benefits may seem harmless—low-cost perks offered without employer contributions. But beneath the surface, many are loaded with high commissions, low value, and virtually no oversight. ERISA doesn’t carve out exceptions just because you didn’t pay for them. Executive Brief: Unpopular Truths About Popular Perks Voluntary benefits are often pitched as employee-friendly…

Signed, Sealed… Sued? If You Didn’t Write the Contract, You’d Better Rewrite the Rules. Most health plan contracts come pre-written—by brokers, vendors, or consultants. But when things go wrong, you’re the one with your name on the line. Under ERISA and the CAA, fiduciaries are legally responsible for what’s buried in the fine print—even if they didn’t negotiate a word of it. If your contract includes gag clauses, audit restrictions, or vague pricing terms you may already be out of bounds….

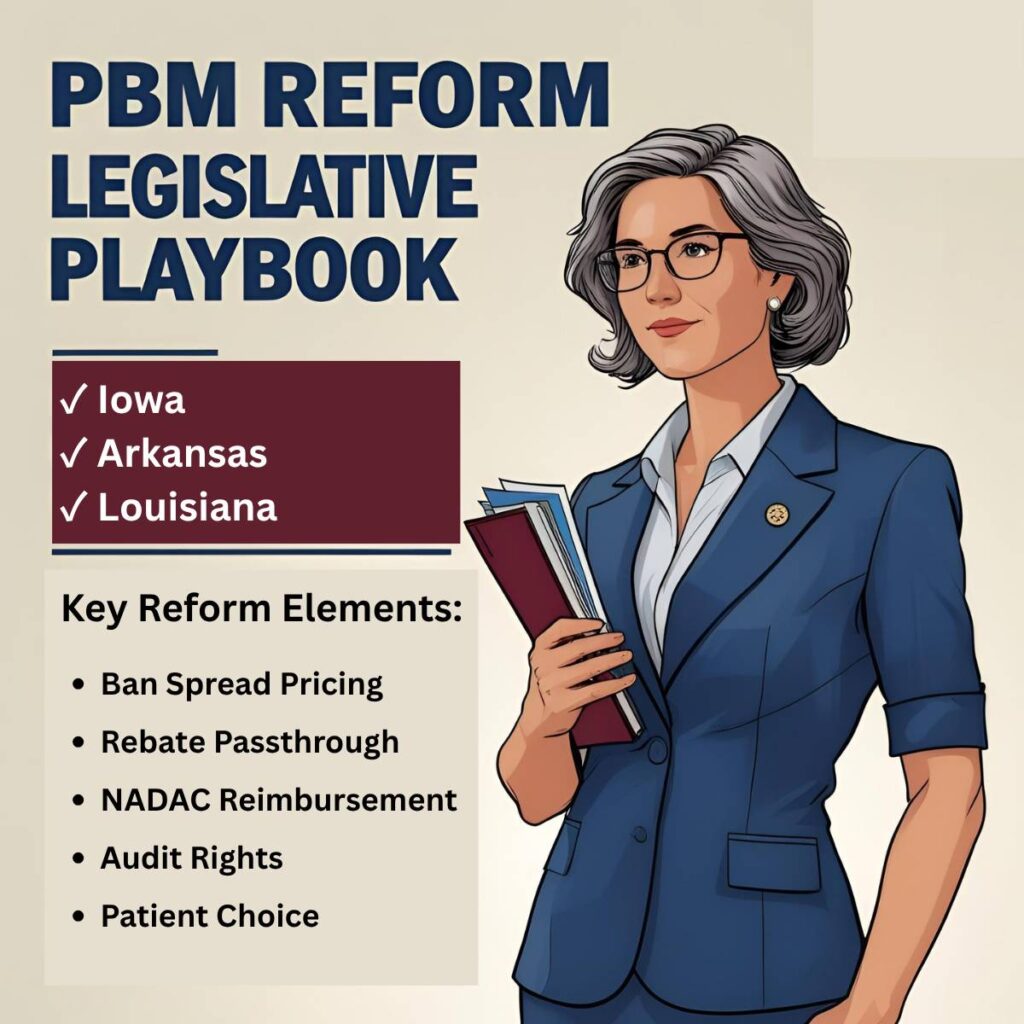

The PBM Reform Playbook State Legislatures Are Doing What Congress Hasn’t Executive Brief State legislatures are cracking down on PBM profit games—banning spread pricing, requiring rebate passthrough, and protecting patient access. The laws vary, but the best ones share a common DNA. Together, they form a de facto playbook for fiduciary-aligned pharmacy benefits. The big takeaway?You don’t need to wait for a new law to act like one applies.You can—and should—start adopting the best parts now….

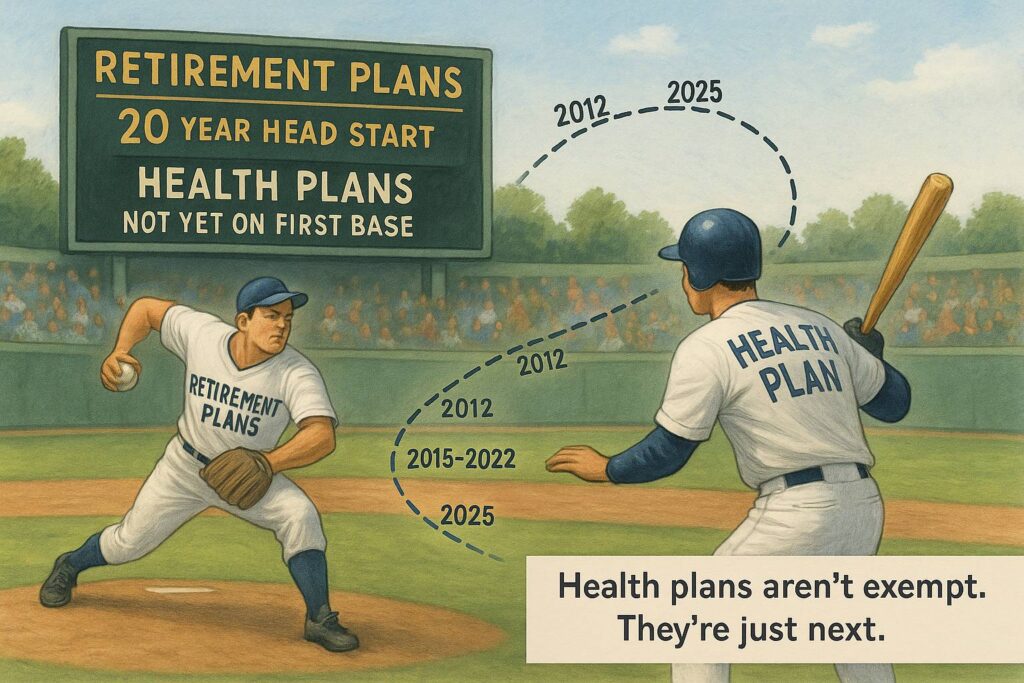

What Health Plans Haven’t Yet Learned from 401(k)s Same law. Same risks. Bigger blind spots. Executive Brief The fiduciary failures we fixed in retirement plans are repeating in healthcare—with higher stakes. Retirement plan litigation forced a generation of fiduciaries to raise their game. They now operate with charters, processes, and accountability. Meanwhile, health plans—with far larger dollar flows—are still run with crossed fingers and handshake deals. This issue explores the…

What I Learned from 25 Newsletters And a Lot of Lawsuits Executive Brief Welcome to Issue #26 of The Health Plan Compliance Advantage. Most newsletters don’t make it past Issue #2—so reaching this milestone feels like a moment worth acknowledging. Over the past six months, I’ve shared stories, lawsuits, case studies, and strategies focused on one core idea: Employer-sponsored health plans are governed by fiduciary duties that are real, enforceable—and increasingly risky to ignore. To everyone…

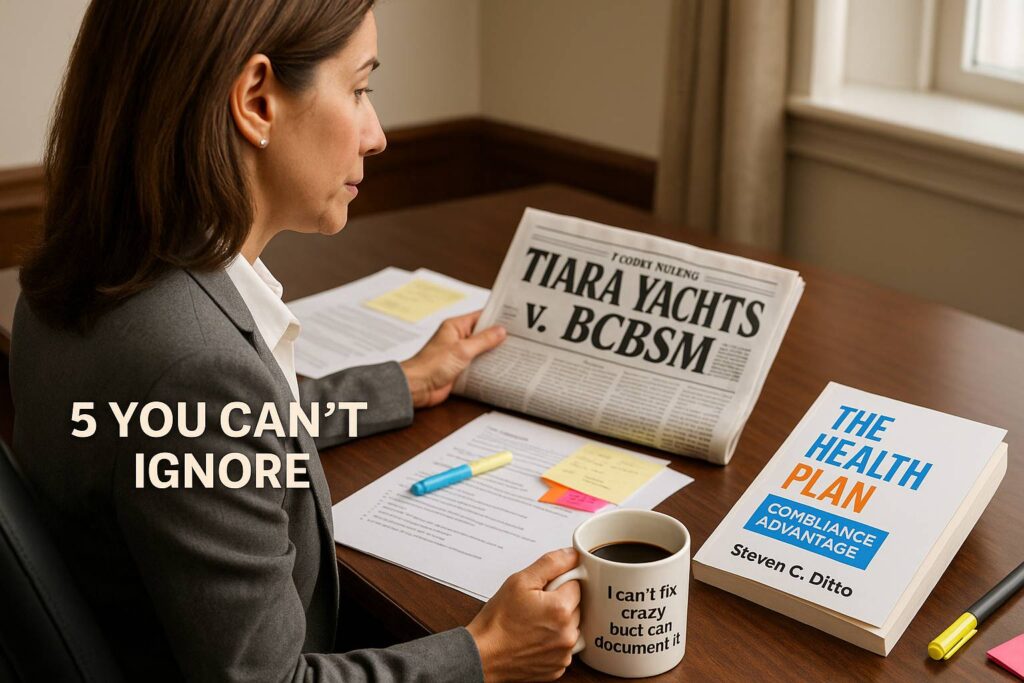

The Fiduciary Lawsuit That Could Change Everything No More “We’re Just Administrators” TPA Defense Executive Brief Can a TPA avoid ERISA liability by calling itself an “administrator”? The Sixth Circuit says no. In Tiara Yachts v. BCBS Michigan (BCBSM), the court crushed one of the industry’s most persistent myths: “We’re not fiduciaries—we’re just following the contract.” The court made it crystal clear:If a TPA manages plan assets, controls payments, and has discretion over compensation,…

Is Your Health Plan Killing the Corner Pharmacy? How employer decisions fuel pharmacy closures—and what you can do about it Executive Brief Independent pharmacies are disappearing—hurting employee care access and driving up long-term healthcare costs. PBMs are a big part of the problem. But health plans that authorize and enable their practices are part of it too. This issue breaks down the risks, exposes the PBM playbook, and outlines practical steps employers can take to protect their…

Employers Say They Put People First Until Someone Gets Sick When that spreadsheet-driven plan design causes delays, denials, or dropped coverage, it’s not just a bad look. It’s a legal liability. Under ERISA and the CAA, fiduciary duty isn’t a slogan—it’s a legal obligation to act solely in the interest of plan participants. Especially when they’re sick, vulnerable, and relying on the benefits you manage to get care they literally can’t afford to lose. The good news? Doing the right thing for…

Why Companies Stick With Bad Vendors The Psychology of Loyalty and the Legal Risk of Doing Nothing You’ve seen the headlines: lawsuits, subpoenas, FTC crackdowns. PBMs, insurers, and brokers are under fire. And yet, most employers haven’t moved. Why not? Because breaking up is hard even when it’s your fiduciary duty. Loyalty ≠ Protection Too many fiduciaries confuse long-standing relationships with protection. “We like them and trust them.” But under ERISA, loyalty is not a defense. The law…

What Health Plan Lawsuits Reveal And How to Stay Out of Them You may never find yourself in court over your company’s health plan. But that doesn’t mean you shouldn’t try to learn what you can from those who have landed there. Over the past months we’ve reviewed ERISA health plan lawsuits—from large Fortune 500 companies to nonprofit health systems. While the details vary, the themes are strikingly consistent. 📰 We Read the Court Filings So You Don’t Have To From JPMorgan to Johnson & Johnson…

Boardroom Risk Alert Fiduciary Failure Leads to Personal Liability Inflation, wage pressure, rising drug costs, and tariffs on products and supplies are squeezing health plan budgets. As costs climb, so does legal risk based on the potential impact on plan participants and beneficiaries. But one move can reduce both risk and cost: rigorous health plan fiduciary compliance. And here’s the part no executive can ignore: Personal Liability Board directors and executives are now directly in the…

Compensation Disclosure Time for Brokers to Come Clean The world of employee benefits is changing—and so is the expectation around who works for whom. For decades, many brokers have operated in a conflicted business model—claiming to serve employers while being paid undisclosed bonuses and incentives by carriers, PBMs, and other vendors. Many carriers offer brokers extravagant “bucket list” rewards—like trips to the Masters golf tournament or all-expense-paid vacations to Paris. Time To Come…

Making Prudent Vendor Decisions A Fiduciary and Strategic Imperative Here’s the uncomfortable truth: Many of the problems plaguing employer health plans are compliance failures rooted in weak procurement practices. In a market dominated by vertically integrated giants, it’s likely your organization has signed multiple health plan contracts that overpay by millions—without transparent pricing, data access, audit rights, or accountability. Staying with the status quo may feel safe. It’s not. A…

Why Employees Pay More for Prescription Drugs What Can Employers Do About It? It’s a question every health plan sponsor should be asking: Why are employees often paying more for their medications than anyone else in the system? According to a 2024 Harvard analysis, it’s not just unfair—it’s potentially harmful. When employees are asked to pay more, they often stop taking the medications they need to stay alive. Who Gets Paid on a $100 Drug? The journey from drug manufacturer to patient…

Smarter Approach to PBM Management The PBM Landscape The Big 6 PBMs—CVS Health, Express Scripts, OptumRx, Humana Pharmacy Solutions, MedImpact, and Prime Therapeutics—control 94% of the market, often using opaque pricing models and misaligned incentives. Beyond this market concentration, an even more worrisome trend is the increasing integration of PBMs with health insurers. This vertical integration reduces competition, increases market power, and limits transparency in cost control and…

Rising Risk of Pharmacy Benefits Board Directors Are Now Named Defendants Recent lawsuits against major corporations highlight a growing risk: PBM mismanagement is leading to overspending, employee dissatisfaction, and breach of fiduciary duties. In the last 12 months, we’ve seen several ERISA class action lawsuits alleging breach of fiduciary duties over pharmacy benefits. The Johnson & Johnson class-action lawsuit, the first to be filed, was amended this week to address the standing of Ann…

Smart Shopping for Healthcare The Employer’s Role in Price Transparency Imagine running a business where employees make purchasing decisions without knowing the cost—only to find out later they overpaid by hundreds or even thousands of dollars. That’s how healthcare works today. Employees have little visibility into costs, and employers bear a big part of the financial consequences. Price transparency isn’t about bargain hunting. It lowers costs, improves benefits, and boosts engagement. The…

Stop-Loss Insurance A Shield with Compliance Cracks Stop-Loss insurance protects self-funded health plans from catastrophic claims, but it comes with hidden risks. Employers must navigate these complexities to ensure Stop-Loss coverage supports—not undermines—their financial and fiduciary responsibilities. Employers must take an active role in structuring their Stop-Loss coverage to align with fiduciary obligations, compliance requirements, and long-term cost containment strategies. One risk…

Mastering Health Plan Contracts Are Your Contracts Hurting Your Plan? Many employers assume their health plan contracts are well drafted. In reality they are often one-sided agreements using vague terms to cover hidden loopholes. These contracts, and the lax procurement processes that created them, often lead to millions in unnecessary spending, compliance risks, and reduced benefits for employees. Real-World Case Study: How One Employer Discovered a $25 PMPM Oversight A mid-sized company was…

Direct Contracting Game-Changer for Cost and Convenience Employers must find new ways to deliver high-quality, cost effective care. One strategy gaining traction is Direct Contracting. Employers bypass insurers and contract directly with providers for primary care, surgery, imaging, testing, and other services. Significance of Out-of-Pocket Spending Out-of-pocket spending accounts for $1 trillion (24%) of healthcare costs, making it vital for employers to maximize value for employees. Direct…

Managing PBM Costs and Risks Key Issues for Plan Sponsors Pharmacy Benefit Managers (PBMs) claim to lower drug costs but often raise them with hidden pricing schemes. These common PBM practices can result in significant compliance risks and financial burdens for both plan sponsors and participants: Lack of Transparency: Opaque contracts hide true costs, making reasonableness and lowest net cost hard to assess. Discounts are meaningless as an indicator of a “good deal.” Drugs are often priced…

Health Plan Management Risks Compliance Failure, Litigation, & Rising Costs Company health plans, often overlooked by boards, now represent a growing legal and financial risk. Just like retirement plans, health plan mismanagement is triggering lawsuits and regulatory scrutiny under ERISA regulations. Employers like Johnson & Johnson, Wells Fargo, and Mayo Clinic face class actions for fiduciary breaches, potentially costing millions. Why This Matters To The Board Material Financial Risk:…

The Advocate Adviser A Crucial Ally For Fiduciary Committees In the complex world of healthcare benefits, an Advocate Adviser is a fiduciary committee’s friend and key resource. They ensure participant needs are prioritized, especially when costly treatments are involved. since this is where participant and plan interests can often collide. An Advocate Adviser is the fiduciary committee’s compass pointing toward the True North of participant interests. The Advocate’s Impact Advocate Advisers,…

Who Should Lead The Fiduciary Committee? Strong Leadership Is Essential Fiduciary committee leadership is about balancing compliance, cost management, and employee well-being—all while navigating complex regulations and vendor relationships. Strong leadership isn’t just a nice-to-have—it’s the cornerstone of compliance, cost control, and delivering meaningful benefits to your employees. The right leader can turn a health plan from a liability into a strategic advantage. So who’s best suited…

The Rise of the Fiduciary Committee First Retirement Plans & Now Health Plans For over two decades, 401(k) plan litigation has transformed retirement plan management due to employers’ breaches of their fiduciary duties. These same ERISA fiduciary standards apply to health benefit plans, but employers have only recently recognized the need for similar governance changes. Lawsuits against major companies like J&J and Wells Fargo emphasize the necessity of establishing fiduciary committees to…

Health Plan Fiduciary 101 What’s It Mean To Be A Fiduciary? The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law setting minimum standards for most employer-sponsored health plans. ERISA defines a fiduciary as someone who must act “solely in the interests of plan participants and beneficiaries.” Behind these formal words lie a simple truth: it’s all about employees and their families. This approach marks a shift from past practices, where employers often prioritized…

“Seething Public Discontent” A Catalyst For Action Although this newsletter has been in the works for months, I rewrote the intro to this inaugural issue in light of recent events. The tragic murder of UnitedHealthcare CEO Brian Thompson has drawn national attention—not just to the act itself but to the anger many feel toward insurers. As Barron’s reported, “The response to Thompson’s murder has uncovered a seething public discontent with private health insurers.” The shell casings reportedly…